NEW YORK (TheStreet) -- Stocks of the nation's largest banks were weak on Tuesday, as investors continued to wait for a deal in Washington and Citigroup (C) continued the weak third-quarter earnings trend.

Citigroup's shares declined 1.5% to close at $48.86, after the company reported third-quarter earnings of $3.2 billion, or $1.00 a share, compared to $4.2 billion or $1.34 a share in the second quarter and $468 million, or 15 cents a share, in the third quarter of 2013. The third-quarter bottom line was boosted by a $500 million recapture of deferred tax assets.

The earnings decline from the second quarter was the main area of concern for investors, since the year-earlier period included $2.9 billion after-tax loss on the valuation of its share of its joint brokerage venture with Morgan Stanley (MS).

Citi's total revenue declined to $18.216 billion in the third quarter from $20.002 billion during the second quarter. The revenue decline in part reflected a sharp increase in provisions for loan losses in the company's Global Consumer Banking segment, because of "portfolio growth and seasoning as well as specific loan loss reserve builds in Mexico related to Citi's exposure to homebuilders as well as the impact of potential losses related to the recent hurricanes in the region." On an overall basis, however, Citigroup's credit expenses continued to decline, as its third-quarter provision for credit losses and for benefits and claims totaled $1.959 billion, declining from $2.024 billion the previous quarter and $2.620 billion a year earlier. Citigroup's third-quarter Securities and Banking revenue totaled $5.081 billion, declining from $6.379 billion the previous quarter and $5.646 billion a year earlier. Many analysts had projected weak third-quarter trading revenue for large-cap banks. Sterne Agee analyst Todd Hagerman in a note to investors Tuesday morning wrote that "overall, the quarter's results were effectively in line with meaningfully lowered expectations, with weak capital markets offset by improved core expenses and lower credit costs." Hagerman rates Citi a "buy," with a $61 price target, estimating the company's earnings will increase from $4.78 a share this year to $5.50 in 2014. Still Waiting for a Deal

The broad indices ended with declines ranging from 0.6% to 0.9% on the 15th day of the partial shutdown of the federal government, as investors continued waiting for an agreement in Washington. No further progress was reported after Senate Majority Leader Harry Reid on Monday said on the Senate floor that he was "very optimistic" he would reach a deal with Senate Minority Leader to Senate Minority Leader Mitch McConnell (R., Ken.) to raise the federal debt limit above $16.7 trillion and resume full government services.

Top 5 Energy Stocks To Invest In Right Now

The Republican leadership of the House of Representatives continues to try to come up with its own deal to restart the government, Reid on Tuesday said a House bill would not pass, and was an attempt to "torpedo" the bipartisan effort in the Senate, according to a Wall Street Journal report.

The clock is ticking, but it seems clear the attitude in Washington is that there is plenty of time to get a deal done, at least to raise the debt ceiling, without coming close to a catastrophic government default on debt payments.

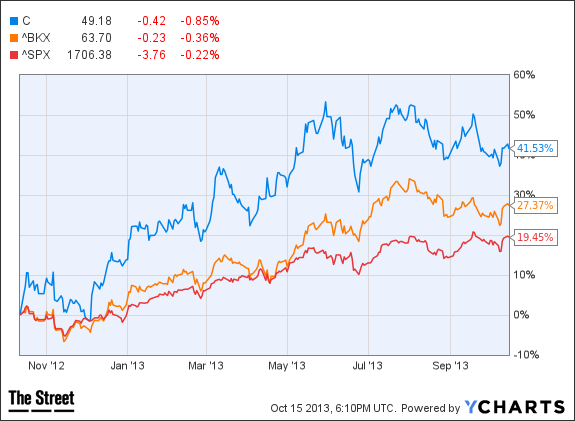

U.S. Treasury Secretary Jack Lew has said the government could run out of money to pay its bills by Oct. 17, without an increase to the debt limit, but some analysts have said the government could probably go on operating until the end of October. The KBW Bank Index (I:BKX) was down 1% to 63.37, with all 24 index components ending with declines. Earnings Season Bank of America (BAC) is last among the "big four" U.S. banks, being scheduled to announce its third-quarter results early Wednesday. Analysts polled by Thomson Reuters on average estimate the company will post third-quarter earnings of $2.126 billion, or 18 cents a share, compared to 32-cent profit during the second quarter and a break-even third quarter of 2012, when debit valuation adjustments and several one-time items wiped out earnings. The consensus third-quarter revenue estimate is $22.034 billion, compared to $22.727 billion the previous quarter and $20.428 billion a year earlier. Bank of America's shares on Tuesday were down 0.8% to close at $14.24. The shares have returned 23% this year and trade for 10.6 times the consensus 2014 EPS estimate of $1.35.  C data by YCharts Interested in more on Citigroup? See TheStreet Ratings' report card for this stock. RELATED STORIES: Bank of America Shrinkfest Has Investors Slavering Citi Shrinks Tax Bill With Crisis Leftovers Citigroup Says it Doesn't Hold Treasuries Due on Oct 31 Citigroup Ups Reserves on Mexican Homebuilder Woes Citigroup Third-Quarter Profit Misses Estimates -- Written by Philip van Doorn in Jupiter, Fla. >Contact by Email. Follow @PhilipvanDoorn

C data by YCharts Interested in more on Citigroup? See TheStreet Ratings' report card for this stock. RELATED STORIES: Bank of America Shrinkfest Has Investors Slavering Citi Shrinks Tax Bill With Crisis Leftovers Citigroup Says it Doesn't Hold Treasuries Due on Oct 31 Citigroup Ups Reserves on Mexican Homebuilder Woes Citigroup Third-Quarter Profit Misses Estimates -- Written by Philip van Doorn in Jupiter, Fla. >Contact by Email. Follow @PhilipvanDoorn

No comments:

Post a Comment