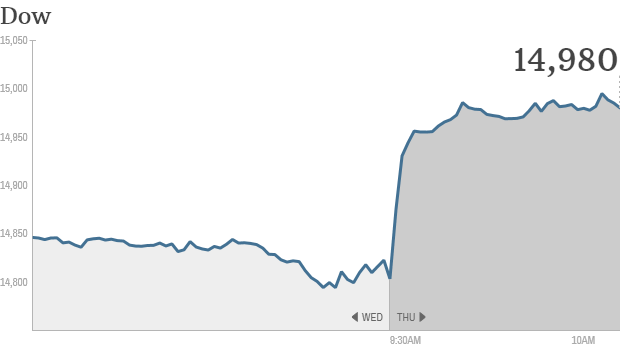

Click chart for more markets data.

NEW YORK (CNNMoney) Stocks rallied Thursday morning on reports that lawmakers could be close to striking a short-term deal that would keep the United States from defaulting on its debt.House Republican members and party leadership sources told CNN that leaders are working on a proposal to raise the debt ceiling temporarily, while the government would remain partially shut down.

The possibility of even a short-term deal was enough to inspire confidence among investors. The Dow, the S&P 500 and the Nasdaq rose more than 1%.

Investors have been growing increasingly concerned as October 17th, a key deadline to increase the debt ceiling, comes closer. Should politicians fail to raise the debt ceiling, the U.S. is likely to default on some of its debt or could be forced to choose between interest payments on the debt and paying for key government services.

Top High Tech Stocks To Own Right Now

Unemployment edging up? Investors saw one sign that should make them uneasy about the jobs market in the U.S., but they seemed content to ignore it Thursday.

The U.S. Labor Department's weekly report on initial jobless claims showed a sharp jump in claims over the previous week. The government did not release its monthly jobs report last week due to the shutdown.

What's moving: Shares of the largest U.S. banks, including JPMorgan Chase (JPM, Fortune 500), Bank of America (BAC, Fortune 500), Citigroup (C, Fortune 500), and Goldman Sachs (GS, Fortune 500), rose more than 1%. JPMorgan Chase and Wells Fargo (WFC, Fortune 500) will report their latest quarterly earnings on Friday morning.

Several large technology stocks popped Thursday, including Netflix (NFLX), eBay (EBAY, Fortune 500), Facebook (FB), Priceline (PCLN) and Tesla (TSLA). Many of these companies, which are among the hottest stocks of the year. had been hit hard in the past few days as the broader market sold off.

Shares of Citrix Systems (CTXS) sank more than 10%, after the software company released its third-quarter results early, saying it expected earnings and revenue to come in lower than previously anticipated.

European markets also jumped, while Asian markets ended mixed.

No comments:

Post a Comment