Summary

On the morning of 09/16, Perion (PERI) announced a long-rumored deal: an all stock "merger" with a much larger but private Conduit division Conduit Connect. The details of the deal are quite simple. Perion will issue 57 to 60 million additional shares, which would give current shareholders a 19% stake in the new company, Conduit and its shareholders will get the remaining 81%. The deal, expected to close in January 2014, is expected to be immediately accretive, assuming Conduit will continue to do as well as before the merger.

The market first reaction was of complete dismay, nicely summarized in this article, with PERI equity plunging at one point over 12%. While Perion recouped most of the losses the next two days, the deal, in my opinion, is incredibly good for Perion shareholders. The investors were blinded by the disappointment of not having an immediate 30-40% pay-off if Perion was bought outright.

Chart 1: Perion equity price near the announcement

(click to enlarge)

I previously wrote a short article describing my due diligence of Conduit Connect. In this article, I will go more into detail about the justification for the merger, why I think the market reaction was misplaced, and what the new company may look like.

Current business

Perion used to be called Incredimail, a "freemium" flagship e-mail application. Several years ago, it drastically changed its business model from trying to upgrade its existing customers to a paid application to installing an Incredimail toolbar and changing browser search to MyStart which was running on top with Google (GOOG) search but displayed additional "sponsored" links. In the last two years, Perion has been very busy buying two privately held companies Sweetpacks and Smilebox, which also made "freemium" applications and converting them to the same business model.

Chart 2: Incredimail Toolbar with the start page vs. Conduit Community Toolbar with the start page (in a couple of favors):

Incredimail:

(click to enlarge)

Conduit:

(click to enlarge)

(click to enlarge)

Rational for a merger

To understand the merger, we have to see how each company benefits from it. In short, Conduit realizes the gains for its founders and investors by getting liquid public shares in the company, while Perion gains the scale and the synergies.

Conduit is a private Israeli company with an estimated $320 million of revenue and $94 million in net earnings (my rough estimates for this year). Unfortunately, there is limited information about the company's financials, its strategy and its revenue because it's private. From the press we can learn that JP Morgan invested $100 million in April last year getting a 7.3% stake. This stake would put private company valuation at about $1.3 billion ($100/0.073). It appears that the company paid $220 to $320 million dividend to its shareholders after the investment, which is quite a statement in support of the company exceptional profitability. Ronen Shilo, the founder, and employees still hold 22% stake in the company. Compared to its partner, Perion is a minnow with an "enterprise value" of only $140 million.

Conduit flagship service offering (and its "cash cow&q! uot;), Co! nduit Community Toolbar, is responsible for the majority of its revenue and was first introduced in 2005. In 2011, the company realized that toolbar business, while very profitable and still fast growing, will eventually slow down and introduced new mobile products, which are not quite yet successful. Today, it combines two business segments: Conduit Connect - a toolbar and several smaller desktop applications business responsible for most of its revenue and an upstart mobile business, which may not be yet profitable, but has a high potential (at least in the eyes of the management). Conduit Connect, responsible for 99% of the revenue, is merging with Perion forming a new company, leaving behind a few non-toolbar apps in the Conduit hands (mobile and some other non-toolbar applications).

Chart 3: New Perion (sources: Perion presentation):

(click to enlarge)

I concluded that Conduit decided to merge to monetize its cash cow business and concentrate on building new apps. Its founder has no interest in running a public company with all the baggage of meeting earnings per share expectations, conducting conference calls, and having to disclose everything the company does. Interestingly enough, the founder and the investors will be subject to the lock-up and Conduit management will be put on Perion board.

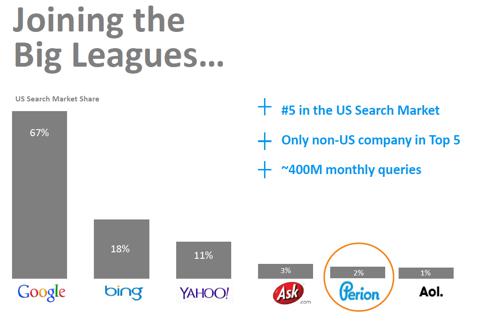

So what's in it for Perion? First of all, Perion gets tremendous economy of scale putting it on the map as the major "paid" search company and a major acquisition target.

Chart 4: Perion search market share (sources: Perion presentation):

(click to enlarge)

InterActiveCorp (IACI) bought Ask.com for $1.85 billion in 2005. The new Perion will be worth only about 40% of that. After the merger, Perion will leapfrog its much larger rivals: Babylon and AVG (A! VG). Fina! lly, Perion should be able to increase its operating margins as it can spread its SG&A costs over a much larger base (Conduit EBITDA margin is 32% vs. Perion's 23%). Perion will keep its senior management team intact: Josef Mandelbaum will remain its CEO and Yacov Kaufman its CFO. Perion has successfully orchestrated a roll-up acquisitions of privately-held Sweetpacks and Smilebox, so I have high confidence that they know how to integrate a new business.

Likely future strategy

As I described earlier, Conduit and Perion have a highly complementary strategy. Conduit Connect doesn't have its own free software but its toolbar is much more advanced than Perion's in its customization options.

Chart 5: Conduit toolbar customization interface (Source: my prior article about Perion):

(click to enlarge)

It's likely that Incredimail/Perion start page and toolbar will be retired and the Perion's apps: Smilebox, Incredimail, and Sweetpacks will use Conduit Community bar instead. This is one of the obvious synergies I see in the new company. They will only need to support the development of a single toolbar and a single "start" page, freeing up expensive development resources.

Perion has agreements with Google, Bing, Yahoo, and Ask.com on paid search revenue sharing while Conduit has an agreement with Bing for US markets (the majority of toolbar users) and Google for non-US users.

Google has updated its installation policies for AdWords affiliates such as browser toolbar makers which became active for most companies early this year. This change led to a number of articles on Seeking Alpha making a short case for AVG and Perion as well as some rebuttals from me and other authors. The biggest flaw in the "short case" was a failure to recognize that Google is not the only game in town. While Google commands a dominant 68% search market share, Bing (MSFT! ) with 18! % and Yahoo (YHOO) with 11% are desperate to keep pace and do not impose equally onerous terms on its affiliates. Conduit dumped Google for Bing almost three years ago for US users. I speculate that the new company will become a predominantly Bing shop (Yahoo also runs on Bing with revenue sharing) removing remaining headwinds from Google policy changes, which put a dent in Perion's and Conduit's revenue this year. If Perion switches to Conduit's search page and toolbar, the switch to Bing for US users would become immediate and automatic.

I also expect that Perion will keep on buying small private software shops on the cheap, just like it did with Sweetpacks and Smilebox, and integrate them into Conduit platform with the Bing as a default search. This "roll-up" strategy will be much cheaper going forward as all toolbar and search business will scale up having a customization platform without any significant additional costs.

Valuation of a new company

There was very little known for certain about Conduit financials until the merger announcement. Last private valuation put Conduit at $1.3 billion. Doing a quick math on the announced merger, the new company should be worth approximately $155/19% = $816 million, which would imply only $660 enterprise value for Conduit Connect. So what happened to the remaining $640 million of Conduit valuation? This article sheds some light on the topic. First of all, Conduit may have paid out as much as $320 million as a dividend. Secondly, the transaction doesn't include Conduit cash, which will be probably distributed to Conduit's shareholders. Finally, even though they only represent 1% of Conduit's revenue, some of the newer apps not included in the transaction, may be quite valuable due to its high potential. However, a large chunk of the Conduit revenue was apparently lost due to Google's new paid search policies starting this year. Perion's presentation provided with pro-forma income statement which shows this significant adjustment. Th! e good ne! ws is, of course, that the revenue hit by now has been largely absorbed by Conduit and the future looks brighter with still $160 million in revenue generated in the first half of this year. In any case, Perion is paying only two times the revenue ($660/(2 * $160)) and 7 times net income ($660/(2 *47) - a very low multiple for a still growing business!

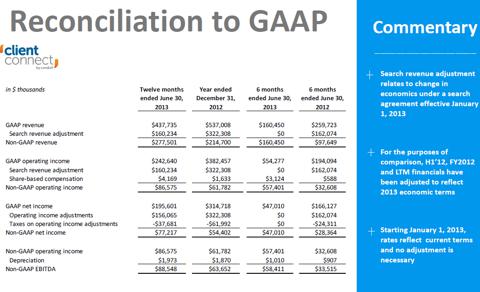

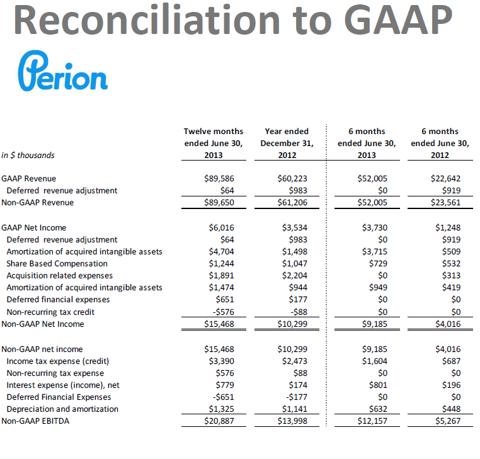

Table 6: Conduit financials (source: Perion presentation):

(click to enlarge)

(click to enlarge)

Combining Perion's and Conduit's number allows us to compare a "new Perion" to its peer group: AVG, IACI, AOL (AOL), and Blucora (BCOR). The numbers are nothing short of incredible demonstrating how grossly the new company is underpriced.

Table 7: Valuation of "new Perion" vs. its peer group:

(click to enlarge)

Note: I use the double of last 6 month earnings and revenues because the new Google policy took place this year, which may have impacted every company. I used only GAAP estimates to be on safe side. PERI net income was substantially impacted by amortization and other expenses related to acquisition of Smilebox. Non-GAAP net income multiple is 8.5x.

I believe that the closest comp to "new PERI" is AVG as it has a very similar business model and impacted by the same changes and is of similar size. By this measure, PERI is now trading at about a 45% discount.

Conclusion:

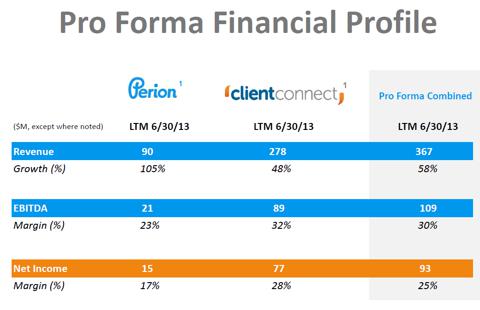

In conclusion, I'd like to leave the readers with this slide, which reflects Perion's management view of the new combined company.

I am a bit skeptical that a 58% growth rate can be sustained, at least without acquisitions. I am more optimistic about th! e margin ! improvements, as I found a large number of synergies allowing for further efficiency improvements beyond what each company accomplished on its own.

Table 8: Combined company (source: Perion presentation):

(click to enlarge)

The new company will have a projected P/E of 8, no debt, and presents a highly desirable acquisition target. Even the most conservative analysis shows that PERI is at least 45% undervalued.

Source: Perion: A Misunderstood And Unappreciated MergerDisclosure: I am long PERI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This is an Alpha-Rich IdeaAlpha-Rich ideas are our best money-making long and short investment ideas. They are released exclusively to Seeking Alpha Pro users 24 hours before publication. Learn more about Seeking Alpha Pro.

No comments:

Post a Comment